The World Gold Council (WGC) pointed out in the latest market report that the interaction between market risk and economic growth is expected to drive gold demand in 2020, among which the main driving forces include financial market uncertainty and interest rate downward, global economic growth slowdown and gold price fluctuation.

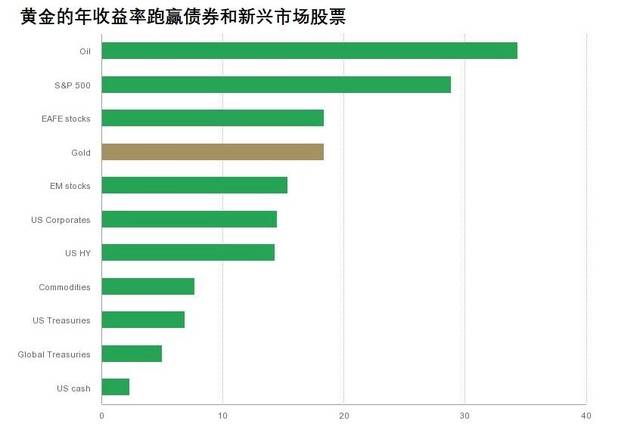

Last year, gold rose 18.4% to its highest level since 2010, outperforming major global bonds and emerging market stocks. In addition, with the exception of the US dollar and the Swiss franc, gold prices in most major currencies hit record highs.

The World Gold Association expects this trend to continue until 2020, based on the fact that many of the global momentum generated in the past few years will continue to support gold, especially the combination of financial and geopolitical risks and interest rate cuts will most likely boost gold investment demand.

"The very low interest rate level in the world will most likely keep the stock market running at a high level and a very high valuation level," the association said. At the same time, while investors may not be able to escape from risky assets, there are signs that as a way of hedging their portfolios, their positions in safe haven assets such as gold are rising. "

The association further said that the global central bank's net gold buying is expected to remain strong, even though it is lower than the record high set in recent quarters. Momentum and speculation will increase the volatility of gold prices. Volatility and slower economic growth are expected to lead to a decline in recent consumer demand, while structural economic reforms in India and China will support long-term demand.

The world gold association did not predict that the volatility of gold would decline in the near future, but said that if the economic and political environment worsened, the volatility would even rise, especially "the volatility of gold has been positive in history under such an environment, and the volatility will rise when the stock market goes down." The association pointed out that with the sharp rise of gold price in 2019, the volatility also increased significantly, but similar to other assets, the volatility is still far lower than its long-term trend.

With regard to the recent tensions in the Middle East, the association said that specific events are likely to affect gold's recent performance, but in the medium term, financial and geopolitical uncertainties and the evolution of monetary policy will play a more important role. |