1、 Introduction to "Indium"

Indium is a rare and precious strategic metal, which is widely used in high-tech fields such as electronic computers, solar cells, photoelectric, national defense and military, aerospace, nuclear industry and modern information industry. At present, there is no other metal that can replace indium in the above fields, so indium has extremely important strategic value. At present, the world's proven metal indium reserves are only 16000 tons, which is 1/6 of the proven gold reserves. With 13000 tons of reserves, China is the world's largest supplier of primary indium.

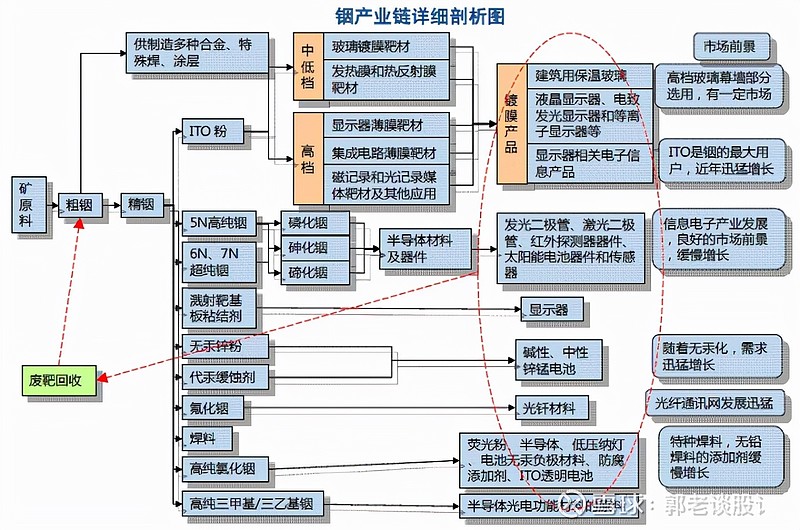

2、 Use of Indium

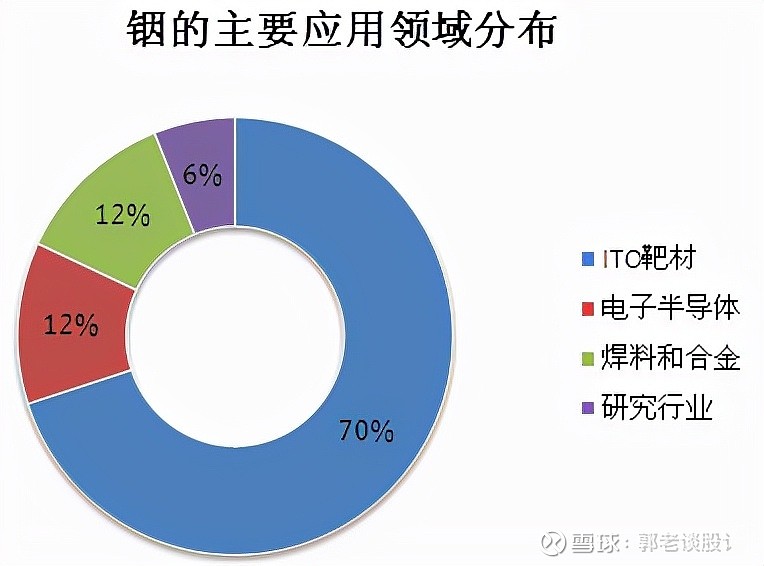

Indium metal is mainly used in notebook computers, televisions, mobile phones and other new liquid crystal displays, contact screens, building glass, etc; As a transparent electrical grade coating, the use of ITO indium target material (accounting for 70% of the height of InU) has increased rapidly, making the demand for indium increase at an annual growth rate of more than 30%. The production of ITO target materials (used to produce LCD and flat screen) is the main consumption area of indium ingots, accounting for 70% of the global indium consumption; Secondly, the field of electronic semiconductor accounts for 12% of the global consumption; Solders and alloys account for 12%; Research industry accounts for 6%. The future application prospect of indium metal in flat panel display (ITO indium tin oxide), solar energy (CIGS copper indium gallium selenium thin film solar cell) and LED industry has increasingly become the mainstream development direction of global emerging industries, so the value of indium should not be ignored by investors.

3、 Metal Indium Price

As of September 13, 2021, the latest industry data of the Nonferrous Metals Association shows that the price of indium metal is currently about 1650 yuan/kg, and the international average price is 230 dollars/kg; The industry insiders told the Associated Press that the price of indium metal rose mainly because of the explosive growth of photovoltaic heterojunction cells. Indium is a rare metal. As long as the production capacity can keep up with it, there is huge room for price increase in the future. The price is 60% higher than that in August, and the current price of indium target material is about 30,000 yuan/kg. (The main technology of indium target material is in the hands of the Japanese industry, which holds about 95% of the global market share.) Internationally, the production cost of metal indium is about $80/kg.

4、 Calculation results and suggestions

Before forecasting the future demand for indium resources, this study first uses the data fitting method to obtain the expected values of five influencing factors, such as the annual GDP growth rate. Considering that the longer the data fitting method is used to predict the future values, the greater the error will be. Therefore, the prediction time in this paper is the next 12 years (that is, until 2030). See Table 2 for the calculation results.

It can be seen from the above calculations that by 2030, China's demand for indium resources will continue to grow, exceeding 300 tons in 2024 for the first time, and 400 tons in 2026. However, the growth rate will gradually slow down after 2028, and basically remain around 500 tons thereafter. Considering the future indium production capacity of China, the domestic output is likely to be unable to meet the demand for indium resources.

proposal

In recent years, China's demand for indium resources has maintained a rapid growth rate, with an average annual growth rate of 13% from 2000 to 2017. In particular, since 2007, China has entered the fast lane. In 2010, there was a super high growth rate of 58%. This is closely related to China's increasing demand for ITO target materials. It is expected that China's demand for indium resources will remain strong in the next 10 years or so. China is a country rich in indium resources. It has world-class indium deposits like Guangxi Nandan Dachang, and also has an increasingly developed smelting and processing capacity. However, objectively speaking, China's indium industry still has problems that need to be solved urgently, such as low resource utilization rate, backward product deep processing technology, and low profit margin, which restrict the development of the industry.

In order to better solve the above problems and make more effective use of indium, an important mineral resource with strategic significance, we believe it is necessary to establish a set of sustainable development strategies for indium resources that are suitable for China's national conditions. Specifically, it can be divided into three parts:

First, gradually adjust the industrial structure of indium. In order to avoid waste of resources and prevent environmental pollution, it is recommended to accelerate the structural adjustment of indium industry and eliminate backward production capacity in accordance with relevant national industrial policies. To speed up the layout and structural adjustment of indium smelting capacity is to strictly control the production scale of indium smelting in densely populated areas in the east, and should focus on imported raw materials and renewable raw materials for production, and earnestly implement the strategy of developing urban mines; The indium smelting capacity in the eastern region should be gradually transferred to the western region, which is rich in mineral resources and large in environmental capacity, to optimize the layout of China's indium smelting industry. Secondly, focus on the centralized recovery and large-scale production of indium. According to the conditions and requirements of resources, environmental protection, technology, safety and other aspects, implement cleaner production and gradually eliminate backward production capacity and traditional processes. Promote the whole industry to develop in a healthy, environmentally friendly and comprehensive way.

The second is to improve the level of technology and product development. Objectively speaking, in terms of using indium resources, the top priority we face is how to overcome technical problems and break through the technical blockade imposed by developed countries in Europe, the United States and Japan. Therefore, we need to increase the research and development of deep processing technology. Take ITO target as an example. For a long time, China lacks the production technology of high value-added indium products. This technology has been controlled by Japanese and Korean companies. Only a few domestic enterprises can produce large-sized LCD TVs. Therefore, our dependence on foreign countries in this area is still more than 90%. It is reassuring that some well-known enterprises in China have realized this problem, started layout as early as possible, and achieved some results. As mentioned above, Hanergy Group made strategic adjustment in 2009 and decided to enter the thin-film solar industry. It has successively invested tens of billions of yuan to acquire foreign advanced technologies, and then through upgrading and transformation, it has filled in the technical gap in CIGS at home. More domestic enterprises should be called on to actively develop the downstream deep processing technologies related to indium resources (such as indium alloy technology, semiconductor compounds, high-purity indium powder and other high-tech), constantly expand the application fields of indium, and improve the technical content of indium products.

Third, it is suggested that the collection and storage of indium should be carried out at the national level. Based on the above discussion, in the near future, it can be predicted that China's ITO target will achieve rapid development, and there is still a gap between the indium production capacity and the demand for indium. It is suggested that the collection and storage of indium should be carried out at the national level in a timely manner. This will not only effectively avoid the impact of international indium price fluctuation on indium production enterprises, but also contribute to the healthy and sustainable development of China's indium industry. Specifically, we should establish a strategic reserve system that focuses on national reserves and combines enterprise and private commercial reserves. The state reserves are mainly physical reserves, supplemented by resource reserves. Drive enterprise reserves and private reserves through national reserves. Effectively control the existing inventory and export through physical reserves, prepare enough indium resources for the future new energy and photoelectric industry, and maintain China's favorable position in the global market.

China Nonferrous Metals News 5. Rare Metals Concept Stock - Indium Resources Listed Company:

Ranking of listed companies producing indium:

1. Tin Industry Co., Ltd. (000960): In 2017, it was reported that the company has rich tin, indium, copper, zinc and other nonferrous metal mineral resources. Gejiu, where the company is located, is one of the regions with the most concentrated tin resources in China, known as the "Tin Capital" of the world. Gejiu mining area has good metallogenic conditions, broad prospects for prospecting, and the company's annual prospecting results are relatively rich. In 2015, the Company acquired 75.74% of the equity of Hualian Zinc Indium through major asset restructuring, establishing its market position as a leader in tin and indium.

2. Zhongjin Lingnan (000060): On March 2, 2011, the relevant personnel of the securities department of the company told the Fortune World TV channel "The Market Is Open Tonight" that the company's annual output of indium is less than 10 tons, mainly recovering indium from gold mines.

3. High Energy Environment (603588): In February 2018, it was reported that High Energy Environment planned to acquire 70.9051% equity of Hongda Environmental Protection with RMB 305 million. According to the announcement, Hongda Environmental Protection holds the Hazardous Waste Business License issued by the Environmental Protection Department of Guizhou Province. The approved business categories include zinc containing waste HW23 and non-ferrous metal smelting waste HW48. The approved business scale is 80000 tons/year, which is the largest in Guizhou It is a comprehensive utilization enterprise of hazardous wastes with the most complete qualification, and its main products include zinc ingot, crude indium, germanium concentrate, lead concentrate, etc. In 2017, the net profit was 27.9203 million yuan.

4. Tibet Everest (600338): The company's main business is smelting and comprehensive recovery of zinc, indium and other non-ferrous metals, and sales of electrolytic zinc, indium and other non-ferrous metal products. In 2014, the company plans to produce 38000 tons of zinc ingots and 48000 tons of sulfuric acid as its leading products; 11000kg of refined indium, 5000 tons of zinc sulfate and 1.95 tons of lead mud (lead content). The sales volume of zinc ingot, sulfuric acid, refined indium, zinc sulfate and lead mud (lead volume) were 38,000 tons, 46,100 tons, 10,900 kg, 8282 tons and 1285 tons respectively. The company holds 56.1% of the equity of Western Indium Industry, which recovers metal indium from the waste and intermediate materials produced by the zinc smelting branch and produces zinc sulfate monohydrate, with an annual output of 10 tons of refined indium and 10000 tons of zinc sulfate monohydrate. The company mainly sells nonferrous metals, including zinc ingots, aluminum ingots and lead ingots, and its leading product is "Lida" brand zinc ingots. (In 2013, Western Indium achieved a net profit of 4.4416 million yuan)

5. Zinc Industry Co., Ltd. (000751): the largest semiconductor metal indium producer in Asia, with an indium production capacity of about 30000 kg/year, accounting for about one tenth of the global total. Indium is widely used in LED, LCD, nuclear reactor control rods and solar cells. In 2011, the production of indium was 20.7 tons, a decrease of 9.1% over the same period of the previous year. (Undisclosed information in 2012 annual report)

6. Hongda Shares (600331): The company's main business is engaged in metallurgy, chemical industry, mining and hotels. Its main products are ordinary superphosphate, compound fertilizer, industrial sulfuric acid, zinc ingot, zinc alloy, zinc oxide, rare metals (molybdenum, indium, germanium), calcium hydrogen phosphate, monoammonium phosphate, potassium dihydrogen phosphate, ammonium bicarbonate, liquid ammonia, zinc oxide ore, etc.

7. Zhuzhou Smelter Group (600961): Zhuzhou Smelter Group is the largest indium producer in China. In September 2010, it signed a package of four contracts for product sales, selling a total of about 100-140 tons of indium ingots. Based on the indium ingot price published by Shanghai Nonferrous Network, the total transaction target is about 340-480 million yuan. Indium ingots are mainly used in the ITO (indium tin oxide) industry, which is widely used in LCD panels. The ITO industry accounts for 70% of the global indium consumption. In the other two emerging consumer areas, CIGS (copper indium gallium selenium) thin film solar cells and LED, aviation bearings and engine bearings, high-tech weapons and other products are inseparable from indium. However, the product has made limited contribution to the company's profits. (In 2013, the gross profit rate of rare and precious products was 1.33%, a decrease of 4.09% over the previous year, mainly due to the decline in the prices of gold, silver and copper.)

8. Luoping Zidian (002114): The company has successfully developed a number of resource comprehensive utilization production technologies that have reached the national advanced level, such as germanium and indium combined extraction, purification workshop residue treatment, leaching residue flotation of silver, and zinc powder plant milling process transformation, which can well realize the extraction of silver, germanium, indium, cadmium and other rare and precious metals from waste residue, and enhance the profitability of the enterprise

Author: Guo Laotan

Link: https://xueqiu.com/2030382516/197689170?ivk_sa=1024320u

Source: Snowball

The copyright belongs to the author. For commercial reproduction, please contact the author for authorization, and for non-commercial reproduction, please indicate the source.

Risk tip: The opinions mentioned in this article only represent personal opinions, and the involved subject matter is not recommended. Therefore, you should bear the risk of buying and selling on this basis.

一、“铟”介绍

铟是稀贵的战略金属,广泛应用于电子计算机、太阳能电池、光电、国防军事、航空航天、核工业和现代信息产业等高科技领域。从目前来看,尚不存在其他金属在上述领域可以替代铟元素,因此铟具有极其重要的战略价值。目前,全球已探明金属铟的储量仅为1.6万吨,是已探明黄金储量的1/6。中国储量1.3万吨,是全球第一大原生铟供应国。

二、铟的用途

铟金属主要用于笔记本电脑、电视、手机等各种新型液晶显示器及接触式屏幕、建筑用玻璃等方面;作为透明电级涂层的ITO铟靶材(占铟泳联高的 70%)用量急剧增长,使得铟需求正以年均30%以上的增长率递增。生产ITO靶材(用于生产液晶显示器和平板屏幕)是铟锭的主要消费领域,占全球铟消费量的70%;其次电子半导体领域,占全球消费量的12%;焊料和合金领域占12%;研究行业占6%。铟金属未来在平板显示(ITO氧化铟锡)、太阳能(CIGS铜铟镓硒薄膜太阳能电池)、LED行业的应用前景越来越成为全球新兴产业的主流发展方向,因此铟的价值不应被投资者忽视。

三、金属铟价格

截止2021年9月13号有色金属协会最新行业数据显示,铟金属的价格目前维持在1650元/千克左右,国际均价在230美元/公斤;这一价格,业内人士对财联社记者表示,金属铟价格上涨,主要是因为光伏异质结电池的爆发性增长。铟为稀有金属,只要产能跟得上,从价格上来说,未来涨价的空间巨大。比8月价格上涨60%,这一价格铟靶材料目前价格约为30000元/千克。(铟靶材料主要技术掌握在日本产业手中,约拥有全球95%市场份额)从国际上来看,金属铟的生产成本大约为80美元/千克。

四、测算结果与建议

在预测未来铟资源需求量之前,本研究首先利用数据拟合法求得GDP年增长率等5个影响因素的预期值,考虑到采用数据拟合法预测未来值时,时间越久误差越大,因此,本文的预测时间是未来12年(即截止到2030年),测算结果详见表2。

由以上测算可知,截止到2030年,中国铟资源需求量将持续保持增长,在2024年首次超过300吨,并在2026年超过400吨,但在2028年后增速逐渐趋缓,此后基本保持在500吨上下。考虑到我国未来的铟产能,国内的产量很可能无法满足铟资源的需求量。

建议

近些年来,中国对铟资源的需求一直保持较快增长速度,2000~2017年年均增速为13%,尤其是2007年以来进入快车道,2010年时曾出现58%的超高增速。这与中国对ITO靶材的需求持续升温有密切关系,预计未来10年左右中国对铟资源的需求依然会保持较强的势头。我国是铟资源很丰富的国家,拥有广西南丹大厂那样世界级的铟矿床,也具备日益发展进步的冶炼加工产能,但是客观地讲,我国铟产业依然存在着资源利用率低、产品深加工技术落后、利润率低等制约行业发展的迫切需要解决的问题。

为能更好地解决上述问题,也为更有效地利用铟这种具有战略意义的重要矿产资源,我们认为有必要建立一套适合我国国情的铟资源可持续发展战略。具体而言,可以分为三个部分:

一是逐步调整铟产业结构。为避免浪费资源、防止环境污染,建议按照国家有关的产业政策要求,加快铟产业的结构调整,淘汰落后产能。加快铟冶炼产能的布局结构调整,就是对东部人口稠密地区铟冶炼的生产规模严格控制,并应以进口原料和再生原料为主进行生产,认真实施开发城市矿山的战略;应逐步将东部地区的铟冶炼产能转移到矿产资源较为丰富、环境容量较大的西部地区,优化我国铟冶炼产业的布局。其次,注重铟的集中回收和规模化生产。根据资源、环保、技术、安全等诸方面的条件和要求,贯彻清洁生产,逐步淘汰落后产能和传统工艺。促使整个行业向健康、环保、综合的方向发展。

二是提高技术和产品开发水平。客观地讲,在利用铟资源方面,我们面临的当务之急就是如何攻克技术难题,突破欧美日发达国家在技术方面的封锁。为此我们需要加大深加工技术的研发。以ITO靶材为例,长期以来,国内缺乏高附加值铟制品的生产技术,这方面的技术一直被日本与韩国公司所把持,国内只有少数企业能够生产大尺寸液晶电视,因此我们在这方面的对外依存度仍然到达90%以上。值得宽慰的是,国内一些知名企业已经意识到这个问题,并及早地开始布局,并取得一些成果。如前文所述的汉能集团,在2009年,汉能集团做出战略调整,决定进入薄膜太阳能产业。先后斥资数百亿元人民币,收购国外先进技术,再通过升级改造,将之国产化,填补了国内在CIGS方面技术空白。应当号召国内更多的企业积极开发有关铟资源下游的深加工技术(例如,铟合金技术、半导体化合物、高纯铟粉等高新技术),不断拓展铟的应用领域,提升铟产品的技术含量。

三是建议在国家层面适时开展铟的收储工作。结合上文论述,在不远的未来,可以预见我国ITO靶材方面会取得较快发展,铟产能与铟需求量之间仍然存在缺口,建议在国家层面适时开展铟的收储工作。这不仅有效避免铟生产企业受到国际铟价波动的冲击,同时也有助于我国铟产业的健康可持续发展。具体来说,即建立国家储备为主、企业和民间商业储备相结合的战略储备系统。国家储备以实物储备为主、资源储备为辅。通过国家储备带动企业储备和民间储备。通过实物储备有效地控制既有库存和出口,为未来新能源和光电产业准备足够多的铟资源,并保持我国在全球市场的有利地位。

中国有色金属报 五、稀有金属概念股-铟资源上市公司:

生产铟上市公司排名:

1、锡业股份(000960):在2017年年报称,公司拥有较丰富的锡、铟、铜、锌等有色金属矿产资源,公司所在地个旧地区是中国锡资源最集中的地区之一,素有世界”锡都”美誉,个旧矿区有良好的成矿条件,找矿的前景广阔,公司每年的找矿成果比较丰硕。2015年公司通过重大资产重组收购华联锌铟75.74%股权后,奠定了公司锡、铟双龙头的市场地位。

2、中金岭南(000060):在2011年3月2日,公司证券部相关人员接受财富天下电视频道《今夜不休市》节目采访时表示,公司铟的年产量不到10吨,主要从金矿中回收铟。

3、高能环境(603588):在2018年2月消息,高能环境拟3.05亿元取得宏达环保70.9051%股权,根据公告,宏达环保持有贵州省环境保护厅颁发的《危险废物经营许可证》,核准经营类别包括含锌废物HW23和有色金属冶炼废物HW48,核准经营规模为8万吨/年,是贵州地区经营规模最大、资质种类最全的危险废物综合利用企业,主要产品包括锌锭、粗铟、锗精矿、铅精矿等。2017年实现净利润2792.03万元。

4、西藏珠峰(600338):公司主营业务为锌、铟等有色金属的冶炼、综合回收,电解锌、铟等有色金属产品的销售。2014年,公司计划主导产品产量锌锭3.8万吨,硫酸4.8万吨;精铟11000千克,硫酸锌5千吨,铅泥(铅量)1.95千吨。分别实现锌锭、硫酸、精铟、硫酸锌、铅泥(铅量)的销售量3.8万吨、4.61万吨、10900千克、8282吨和1285吨。公司持有西部铟业56.1%的股权,西部铟业从锌冶炼分公司所产生废料及中间物料中回收金属铟并产一水硫酸锌,年产10吨精铟和1万吨一水硫酸锌。公司主要销售产品为有色金属,包括锌锭、铝锭和铅锭,主导产品为“力达”牌锌锭。(2013年,西部铟业实现净利润444.16万元)

5、锌业股份(000751):亚洲第一大的半导体金属铟生产企业,铟产能约3万公斤/年,占全球的十分之一左右。铟在LED、液晶显示器、核反应堆控制棒和太阳能电池等领域被广泛应用。2011年生产铟20.7吨,比上年同期降低9.1%。(2012年年报未披露情况)

6、宏达股份(600331):公司主营业务是从事冶金、化工、矿山开采及酒店,主要产品为普通过磷酸钙、复合肥、工业硫酸、锌锭、锌合金、氧化锌、稀有金属(钼、铟、锗)、磷酸氢钙、磷酸一氨、磷酸二氢钾、碳酸氢铵、液氨、氧化锌矿石等。

7、株冶集团(600961):株冶集团是国内最大铟生产商,2010年9月签署产品销售一揽子共4个合同,出售总计约100-140吨铟锭,以上海有色网公布铟锭价格计,全部交易标的约3.4亿-4.8亿元左右。铟锭主要用于ITO(氧化铟锡)行业,广泛应用于液晶显示面板,ITO行业占全球铟消费量70%,另外两个新兴消费领域CIGS(铜铟镓硒)薄膜太阳能电池和LED,航空轴承和发动机轴承、高科技武器等产品都离不开铟。但该产品对公司盈利贡献有限。(2013年,稀贵产品毛利率为1.33%,比上年下降4.09%,主要是金、银、铜等价格下跌所致。)

8、罗平锌电(002114):公司已成功开发出锗铟联提、净化车间渣处理、浸出渣浮选银、锌粉厂制粉工艺改造等多个已达全国先进水平的资源综合利用生产技术,能很好地实现从废渣中提取银、锗、铟、镉等稀贵金属,增强了企业的盈利能力

作者:郭老谈股讠

链接:https://xueqiu.com/2030382516/197689170?ivk_sa=1024320u

来源:雪球

著作权归作者所有。商业转载请联系作者获得授权,非商业转载请注明出处。

风险提示:本文所提到的观点仅代表个人的意见,所涉及标的不作推荐,据此买卖,风险自负。